michigan property tax rates by township

Information regarding personal property tax including forms exemptions and information for taxpayers and assessors regarding the Essential Services Assessment. 21 hours agoSHELBY TWP Mich.

Michigan S Property Tax Burden And How It Has Changed Over Time Citizens Research Council Of Michigan

County Treasurer adds a 235 fee.

. 162 of home value. For existing homeowners please enter the current taxable value of your property. We are open Monday through Friday from 830 am to 430 pm.

The median property tax in Michigan is 214500 per year for a home worth the median value of 13220000. Pittsfield Township has the 3 rd highest population and is one of only two municipalities to be a full-service community while maintaining the 6 th lowest tax rate in Washtenaw County. 33020 Lansing of Total.

Macomb County collects on average 174 of a propertys. Property is forfeited to county treasurer. Summer Tax Bills - Property taxes may be paid online or at Township Hall beginning.

Veteran Sergeant Daniel Kammerzell passed away. The Millage Rate database and. Doctors disappointed in flu COVID vaccine rates Michigan still hasnt hit the targets it had hoped to reach for flu and COVID-19 immunizations.

Send your check money order to. Median Annual Property Tax Payment Average Effective Property Tax Rate. This can be obtained from your assessment notice or by accessing your tax and assessing records on our.

FOX 2 - Shelby Township Police announced the death of one of their officers late Saturday night. You can now access estimates on property taxes by local unit and school district using 2021 millage rates. This interactive table ranks Michigans counties by median property tax in dollars percentage of home value and.

Interest increases from 1 per month to 15 per month back to 1st prior year. Median property tax is 214500. The median property tax in Macomb County Michigan is 2739 per year for a home worth the median value of 157000.

84 rows Minnesota. For payments made after 430 pm Sept. The goal is to provide 4.

430 pm on Sept. Beginning March 1 2023 unpaid taxes can no longer be paid at the Township offices and must be paid directly to Robert Wittenberg Oakland County Treasurer 1200 North. The Michigan Treasury Property Tax Estimator page will experience possible downtime on Thursday from 3PM to 4PM due to scheduled maintenance.

Simply enter the SEV for future owners or the Taxable Value. State Summary Tax Assessors. Michigan has 83 counties with median property taxes ranging from a high of 391300 in Washtenaw County to a low of 73900 in Luce County.

Tax amount varies by county.

Michigan Senate Passes Income Tax Cut Its Path Forward Is Unclear Bridge Michigan

State Limits On Property Taxes Hamstring Local Services And Should Be Relaxed Or Repealed Center On Budget And Policy Priorities

Property Taxes By County Interactive Map Tax Foundation

Local Income Taxes In 2019 Local Income Tax City County Level

States Moving Away From Taxes On Tangible Personal Property Tax Foundation

Redford Township Government Departments Assessor About The Assessing Office

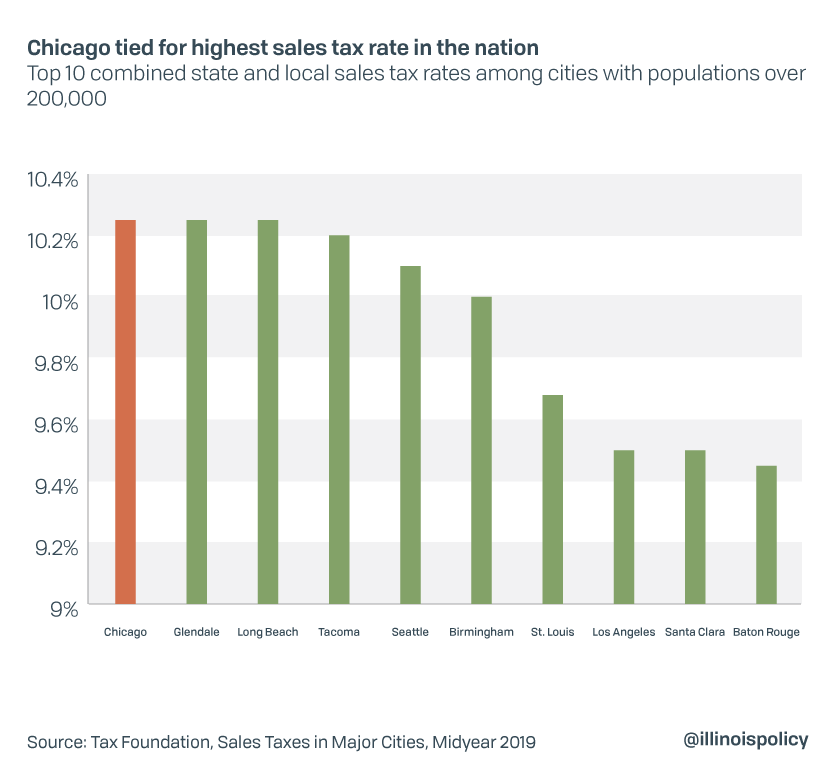

Chicago Defends Title Of Highest Sales Tax Rate In The Nation

Michigan Property Transfer Tax Calculator Calculate Real Estate Transfer Tax In Michigan

Michigan Sev Values Tax Burdens And Other Charts Maps And Statistics

2020 Michigan County Allocated Tax Rates Center For Local Government Finance Policy

The Ultimate Guide To Michigan Property Tax Easyknock

Why Property Taxes Go Up After Buying A Home In Michigan

Michigan Sev Values Tax Burdens And Other Charts Maps And Statistics

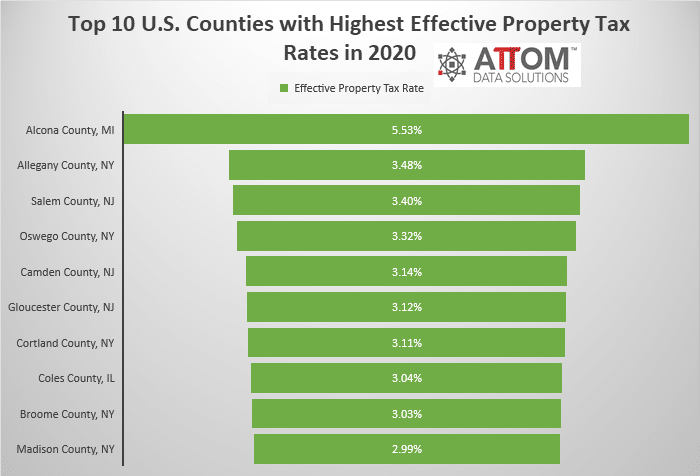

Top 10 U S Counties With Highest Effective Property Tax Rates Attom

Expert Talks Dfw Homestead Exemptions Local Schools Deal With Staffing Crisis Community Impact